Translating Lender Logic Into Action

Adaptive AI

Where Capital Decisions Begin

Before funding becomes the focus, most entrepreneurs reach a point where something feels uncertain — not enough to stop them, but enough to make the next step carry more risk than it should.

This is the moment to understand how your business is being evaluated — across structure, timing, and signals that don’t show up on a checklist, but still influence decisions.

ALFRED sits here.

Not to push you forward, speed things up, or promise results — but to give you clarity about where you stand, so you can decide when and how to move.

The ALFRED Advantage

What is ALFRED?

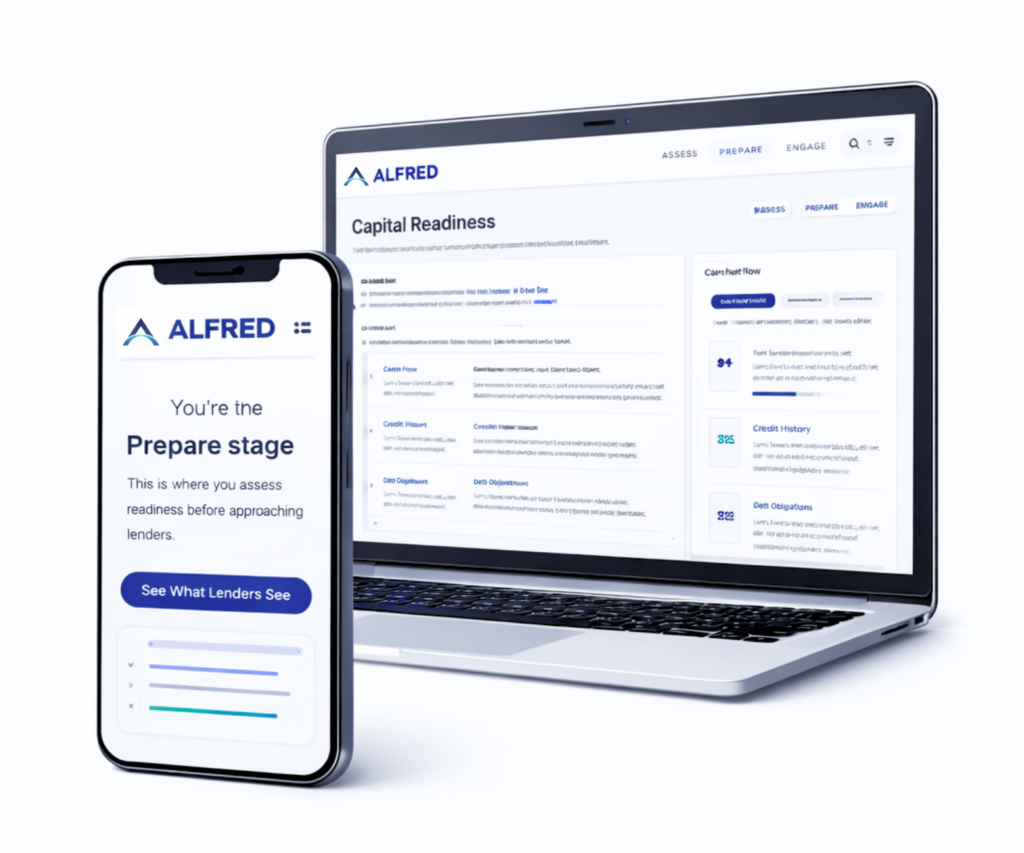

ALFRED is a decision-support system for capital readiness.

It helps you understand how lenders are likely to interpret your business before you submit an application or commit to a financing path.

ALFRED surfaces the capital readiness signals lenders evaluate — across cash flow behavior, business structure, documentation, and timing. You see where things are aligned, where gaps exist, and where decisions may be premature.

This allows you to approach capital intentionally, rather than reactively.

The Lenders Lens

Understand how underwriting logic interprets your business before you submit anything.

Funding Alignment

Surface gaps lenders notice — without finding out through a denial.

Tracked Readiness

Readiness isn’t a switch. ALFRED reflects how evaluation changes as your business changes.

Capital Options

When urgency slows and clarity is present, capital options surface in readiness — not pressure.

Built for Clarity Before Capital

For Entrepreneurs Who

- Are tired of guessing what actually makes their business fundable

- Want clarity before submitting denied application

- Need funding but don’t know where to start

- Want to know how the lender sees their business

- Are building something real— but need help scaling

Early access includes readiness tracks and lender-view diagnostics.

ALFRED IN ACTION

How it Works?

ALFRED meets you where you are— then helps you move forward with clarity. You are not rushed toward action. It helps you understand where you are—before decisions stack up.

DISCOVER

Start with a short diagnostic that surfaces how your business is currently being seen—by structure, timing, and readiness signals.

PAUSE

You see how your business is currently being evaluated and where alignment is incomplete.

This creates space to pause before making a capital decision.

PREPARE

As conditions change, ALFRED reflects what that means for readiness. You decide what to address, what to pause, and what can wait.

PROCEED

Capital options are visible and aligned with your readiness.

You decide whether to proceed based on timing, context, and risk — not pressure.

Real time analytics

Strategic tools

Financial Decision Intelligence

Lender matching

Machine learning

Real time analytics

Strategic tools

Financial Decision Intelligence

Lender matching

Machine learning

Real time analytics

Strategic tools

Financial Decision Intelligence

Lender matching

Machine learning

Easy to use platform

Adaptive Intelligence

Smart banking

Capital Readiness

Lender Logic

Easy to use platform

Adaptive Intelligence

Smart banking

Capital Readiness

Lender Logic

Easy to use platform

Adaptive Intelligence

Smart banking

Capital Readiness

Lender Logic

Easy to use platform

Adaptive Intelligence

Smart banking

Capital Readiness

Lender Logic

FAQs

Frequently asked questions

What is ALFRED?

ALFRED is a financial decision intelligence platform for capital readiness. It shows you how lenders evaluate your business so you can understand what’s aligned, what isn’t, and when it actually makes sense to move forward.

Is ALFRED just another business app?

No. ALFRED isn’t task management or templated advice. It’s a smart, adaptive platform that gets to know you and curates strategic actions that fit your style, vision, and growth goals.

How does ALFRED learn about me?

ALFRED starts with a readiness diagnostic and continues by tracking behavioral, structural, and financial signals. As those signals change, what you see changes—without pressure to act.

Who is ALFRED for?

ALFRED is for entrepreneurs who feel urgency around capital but want clarity first. It’s especially useful when you’re unsure whether pushing forward—or pausing—is the smarter decision.

Does ALFRED help me get funding?

Yes. When your business reaches the Proceed state, ALFRED can surface aligned capital options and create a lender-ready file based on your verified readiness signals. You choose if and when to submit—and which lenders to submit to—as alignment becomes visible inside Insights.

What does ALFRED stand for?

ALFRED reflects its purpose, not an acronym. It functions as a decision-support system that translates lender logic into visibility and context.

How is ALFRED different from ChatGPT or AI tools?

ALFRED isn’t a conversational tool. It’s a structured system designed around how capital decisions are evaluated, not how questions are answered.

Do I need to be tech-savvy to use ALFRED?

No. ALFRED is designed to reduce complexity, not add to it. You focus on understanding your position; the system handles interpretation.

Is ALFRED free?

ALFRED is currently available through early access. Waitlist users receive access to readiness diagnostics and select insights during beta.

When will ALFRED launch?

ALFRED is onboarding early users in phases. Joining the waitlist is the best way to access the platform as new capabilities are released.

Have another question? Email our team→

Ready to see where your business actually stands?

Understand your capital readiness before you decide what to do next.